Here’s something surprising – your average savings account barely earns 0.5% APY, while some of America’s best banks offer rates up to 6.17%. You could be missing out on some serious returns.

The US banking landscape can be overwhelming with its 4,100 commercial and savings banks. Big players like JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup rule the market. However, smaller banks such as DCU and UFB Direct are turning heads with their high savings rates and customer-focused features.

My detailed analysis covers everything from APY rates and minimum deposits to ATM networks and digital features. This piece will guide you to pick the right bank that matches your 2025 financial goals. You’ll learn about high-yield savings accounts, wide ATM coverage (Bank of America’s network has 15,000 ATMs), and powerful digital banking tools.

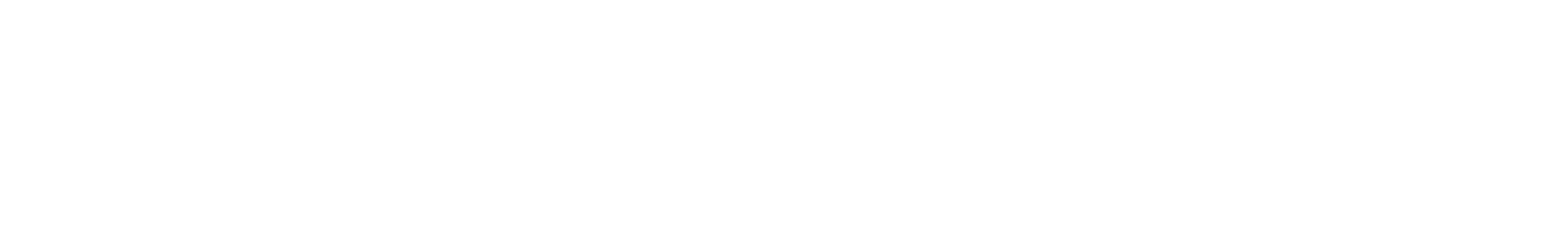

Chase Bank: Ultimate Rewards and Savings Benefits

Image Source: Chase Bank

Chase distinguishes itself from other American banks through its detailed savings benefits and rewards integration. The bank provides three savings account tiers – Chase Savings℠, Chase Premier Savings℠, and Chase Private Client Savings℠.

Chase Savings Account Features

Chase Savings℠ accounts include Autosave that moves money automatically from checking to savings accounts to help you meet financial goals. Account holders can access 15,000 ATMs and more than 4,700 branches across the nation. Chase Premier Savings℠ accounts give relationship rates when you link them to a Chase Premier Plus Checking℠ or Chase Sapphire℠ Banking account.

Credit Card Rewards Integration

Chase Ultimate Rewards® program stands out with its flexible point redemption system. Members earn 1-15 bonus points per dollar at over 450 stores through Shop through Chase®. Points transfer to airline and hotel partners at a full 1:1 value with select cards.

The program lets you redeem points in several ways:

- Travel bookings through Chase’s portal

- Statement credits or direct deposits

- Gift cards from over 175 brands

- Purchases through Amazon.com and PayPal

Sign-up Bonuses and Promotions

Chase regularly offers attractive welcome bonuses. New Chase Total Checking® customers can earn $300 by setting up direct deposits totaling $500 or more within 90 days. The bank’s referral program lets existing customers earn up to $500 yearly by referring friends – $50 for each successful referral.

Chase Digital Banking Tools

Chase Mobile® app improves banking with innovative features. The built-in budget tool helps you track spending patterns and create customized budgets based on monthly income and bills. The app’s Spending Planner tool lets you:

- Set savings targets

- Monitor monthly bills

- Track discretionary spending

- Visualize spending trends through bar charts and tables

Chase QuickDeposit lets you deposit checks remotely and makes funds available by the next business day. Account alerts notify you about transactions, though message and data rates may apply.

The app’s Autosave feature makes saving easier by automating transfers between accounts. This approach helps customers reach their financial goals without manual effort.

Capital One 360: Best for High-Yield Savings

Image Source: Capital One

Capital One 360 Performance Savings stands out as a top choice for Americans who want high-yield returns. The account pays a competitive 3.70% APY that’s by a lot higher than the national average of 0.41%.

360 Performance Savings Features

The account gives you online banking convenience with traditional banking security through its network of 280+ physical branches in eight states and Washington, DC. Account holders get:

- FDIC insurance protection up to allowable limits

- Mobile check deposits through Capital One’s top-rated app

- Multiple savings accounts to track different financial goals

No-Fee Banking Benefits

Traditional banks can’t match Capital One 360 Performance Savings when it comes to eliminating fees. You don’t need a minimum deposit to open an account and there are no monthly maintenance fees. This fee-free approach means you keep all your earned interest, which helps your savings grow faster.

Automated Savings Tools

AutoSave is the life-blood of building wealth systematically. The mobile app lets you:

- Create custom savings rules

- Schedule transfers based on your preferred timing

- Set up automatic transfers on payday

You can set up many recurring transactions at once to manage different savings goals.

Capital One Shopping Rewards

Capital One’s free Shopping service adds extra value beyond regular banking perks. This browser extension and mobile app helps you save money through:

- Automatic coupon testing at checkout

- Price checks across 30,000+ online stores

- Alerts when tracked items drop in price

You can redeem Shopping rewards for gift cards from over 50 retailers. These rewards work separately from other Capital One programs, giving you another way to save.

The bank’s free CreditWise service tracks your credit score and alerts you about credit report changes. It also watches the darknet to protect your personal information and prevent identity theft.

The account’s smooth connection with Capital One’s checking gives you quick fund transfers and access to 70,000+ fee-free ATMs. You can also visit Capital One Cafés nationwide to talk about banking or get free financial advice while enjoying coffee.

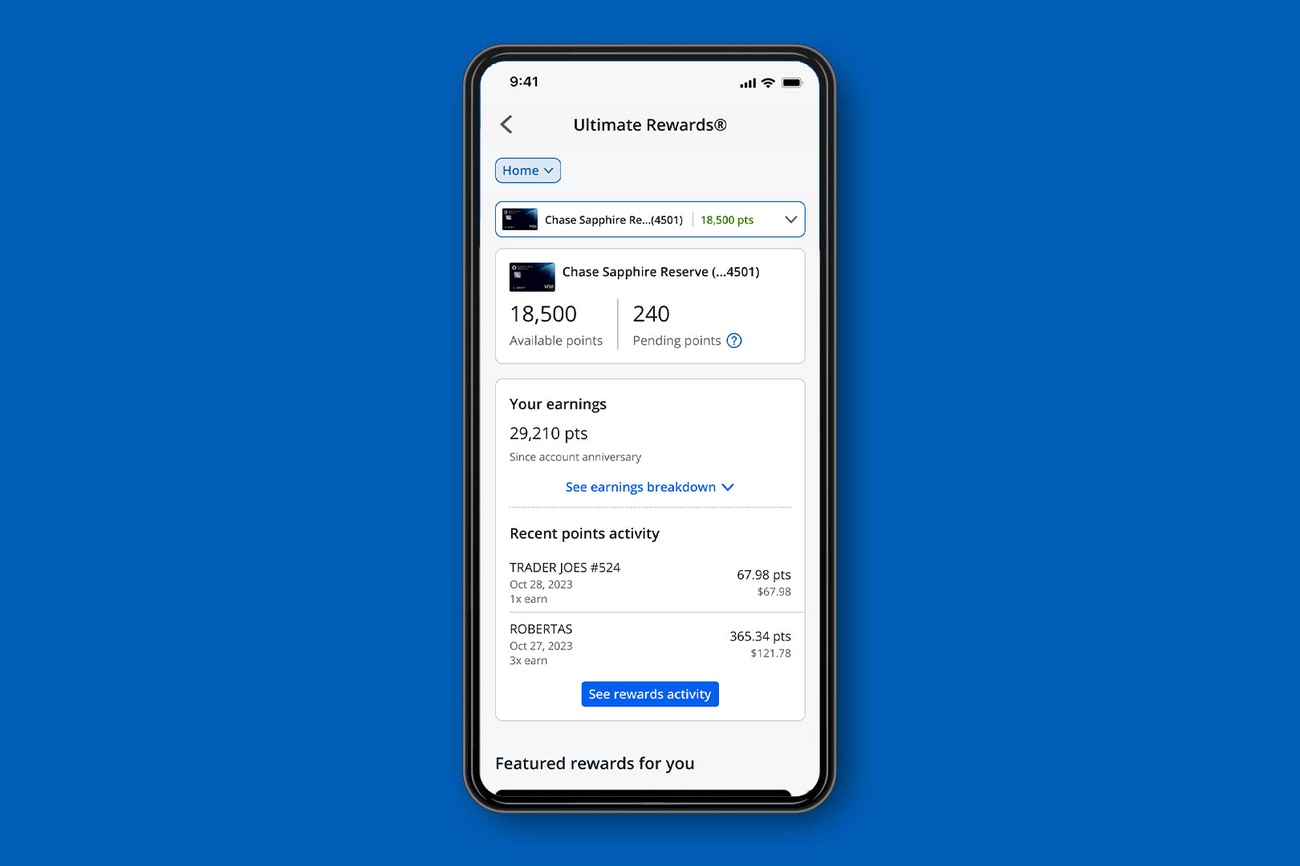

Ally Bank: Top Online Savings Features

Image Source: The Rideshare Guy

Ally Bank stands out with its innovative digital tools and competitive interest rates for online savings. The bank’s savings account earns a 4.20% APY, making it one of America’s top-performing financial institutions.

High-Yield Account Options

You can open and maintain an Ally Online Savings Account with no minimum balance. Your money grows faster as interest compounds daily. Account holders can make unlimited deposits and access their money at over 43,000 free Allpoint® ATMs nationwide.

Smart Savings Buckets

Ally’s signature savings buckets feature gives customers a new way to organize their money. A single account can hold up to 30 custom buckets that help you save for specific goals like:

- Emergency funds

- Vacation savings

- Home down payments

- Education expenses

You won’t need multiple accounts with this bucket system. Everything stays organized in one place, and interest applies to your total balance, whatever way you split your money between buckets.

Round-Up Savings Program

The Round-Up program helps you save more money from everyday purchases. The system works by:

- Tracking spending from linked Ally accounts

- Rounding each purchase to the nearest dollar

- Moving the difference to savings once USD 5.00 builds up

Ally’s “boosters” program offers many more ways to grow your savings. The Surprise Savings feature looks at your linked checking accounts, finds extra money you can safely save, and moves it to your savings automatically.

The bank shows its steadfast dedication to customer service with zero monthly maintenance fees and no overdraft charges. The mobile app lets you:

- Create savings goals with target dates

- Track your progress with individual-specific charts

- Set up automatic recurring transfers

- Deposit checks from your phone using eCheck Deposit

Ally’s customer support team works 24/7 through phone, online chat, or the mobile app. The bank gives back up to USD 10.00 monthly in out-of-network ATM fees, so you can access your money easily.

The bank’s data shows that customers who use Ally’s smart savings tools save about twice as much as those who don’t. These numbers prove how well Ally combines digital banking with automated savings features.

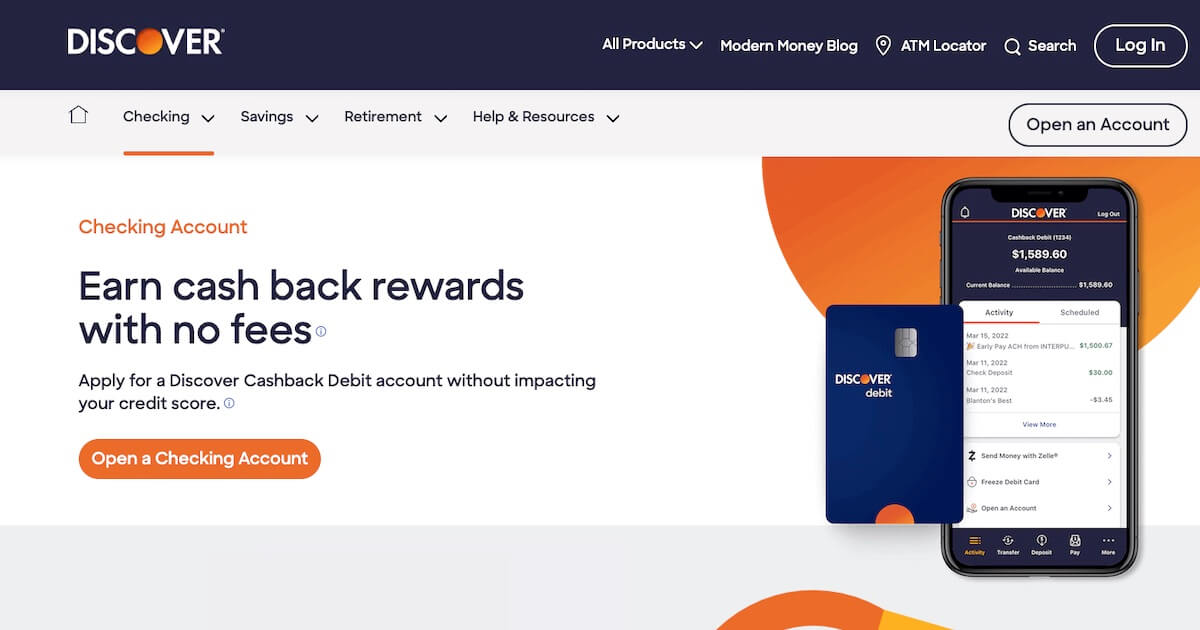

Discover Bank: Cashback Checking Champion

Image Source: Discover

Discover Bank makes checking accounts better with its new cashback program and zero fees. The Discover Cashback Debit account lets customers earn credit card-style rewards without debt risks.

1% Cashback Debit Rewards

Discover’s checking account stands out because of its rewards program. Account holders can earn 1% cash back on up to USD 3,000 in debit card purchases each month. This adds up to USD 360 in yearly savings. The rewards show up in the account’s Rewards Detail section when the month ends.

Customers can use their cashback rewards in several ways:

- Direct deposit to Discover checking accounts

- Transfer to Discover Online Savings Account

- Deposit to Money Market Account

- Sign up for automatic monthly transfers

No-Fee Banking Structure

Discover’s steadfast dedication to fee-free banking makes it different from other banks. The account has no charges for:

- Monthly maintenance

- Insufficient funds

- Official bank checks

- Quick card replacement delivery

- Account closure

Customers can use over 60,000 ATMs nationwide without fees. The Early Pay service gives access to direct deposits two days before the scheduled date.

High-Yield Savings Integration

Discover’s Online Savings Account works smoothly with checking to boost earnings. The savings account offers an APY more than five times the national average as of March 2025. This high-yield account stays true to the bank’s no-fee approach with:

- No minimum deposit needed

- Interest compounds daily

- FDIC insurance coverage

- U.S.-based support available 24/7

The bank’s easy-to-use mobile app makes account management simple. Users can move money between accounts, set up automatic transfers, and track cashback earnings. App Store users praise the platform’s straightforward access to customer support.

Discover stands out as a top choice for Americans who want to get the most from their banking. The mix of cashback rewards, extensive free services, and high-yield savings makes it attractive. The bank’s clear approach removes hidden fees, which helps customers keep more of their money whether spending or saving.

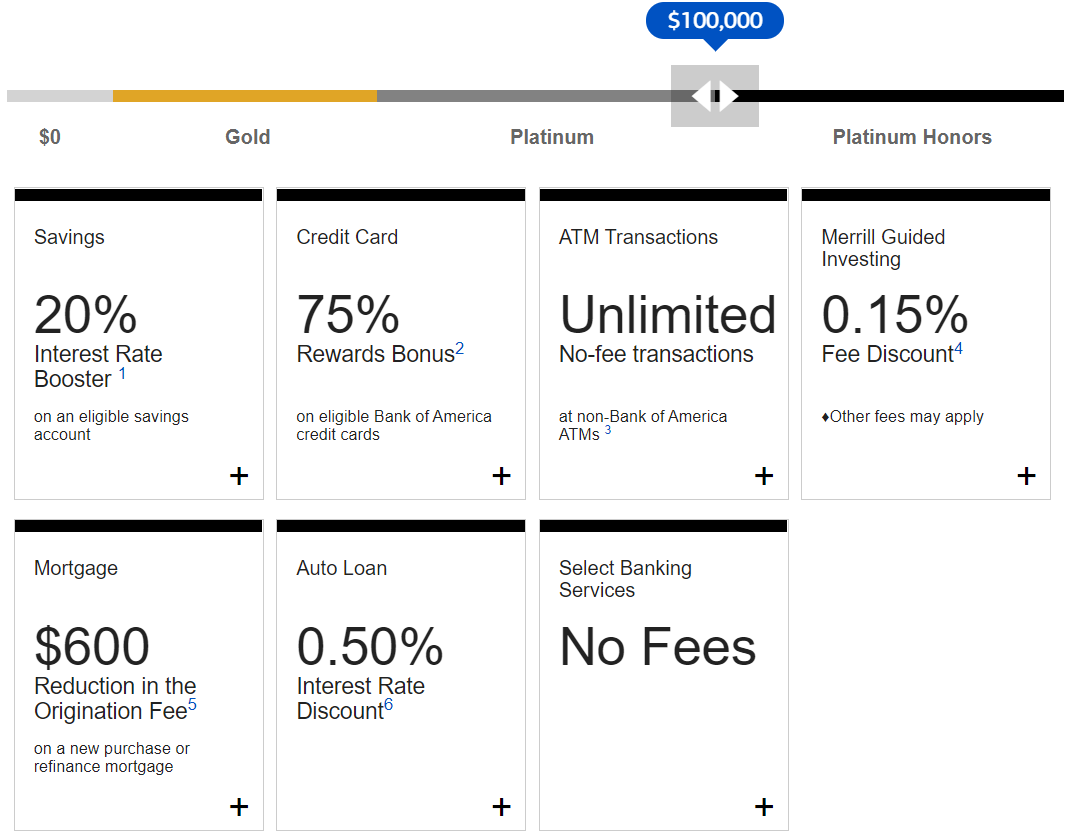

Bank of America: Preferred Rewards Program

Image Source: Million Mile Secrets

Bank of America’s Preferred Rewards program shows excellence in relationship banking. The program offers increasing benefits in five tiers based on combined account balances.

Relationship Banking Benefits

Members don’t pay enrollment fees and keep their benefits for a full year even when balances drop temporarily. The program includes several perks:

- Money back on ATM fees at non-Bank of America locations

- Direct access to priority customer service

- Lower rates on mortgages and auto loans

- Better foreign currency exchange rates

Investment Integration Features

The new unified mobile platform gives members complete financial management tools that bring together banking, investing, and retirement planning. Members can:

- View all financial products in one place

- Use Life Plan® and Net Worth Estimator™ tools

- Send international wire transfers in more than 140 currencies

- Pay bills and move money between accounts

BofA Rewards Program Tiers

The program has five tiers based on three-month average daily balances:

- Gold (USD 20,000 – USD 49,999):

- 25% extra credit card rewards

- 5% higher savings interest rate

- USD 200 off mortgage origination fees

- Platinum (USD 50,000 – USD 99,999):

- 50% extra credit card rewards

- 10% higher savings interest rate

- USD 400 off mortgage origination fees

- Platinum Honors (USD 100,000 – USD 999,999):

- 75% extra credit card rewards

- 20% higher savings interest rate

- No fees at any ATM

- Diamond (USD 1M – USD 9.99M):

- Premium lifestyle benefits

- 0.625% discount on home equity lines

- Access to exclusive events

- Diamond Honors (USD 10M+):

- Top-tier benefits

- Best relationship rewards

- Custom banking solutions

Savings Account Options

The Advantage Savings account works naturally with the Preferred Rewards program and offers better interest rates as you move up tiers. Gold members earn 0.02% APY, Platinum members get 0.03% APY, and Platinum Honors members and above receive 0.04% APY. Account features include:

- No monthly maintenance fees

- Programs to save automatically

- Deposit checks through your phone

- Instant account alerts

The program’s digital use grew significantly in 2023. Clients connected to their accounts 23.4 billion times, which was 11% more than the previous year. Today, more than 19 million clients use Erica, the bank’s virtual financial assistant, to manage their accounts better.

Citibank: Global Banking Advantages

Image Source: 10xTravel

Citibank stands out as a banking powerhouse that serves customers in nearly 160 countries. Their vast network makes cross-border transactions smooth and provides complete financial management services to international clients.

ThankYou Points Program

Citi ThankYou® rewards program gives great value through various redemption choices. Members can earn points on purchases and redeem them for:

- Travel bookings through Citi’s portal

- Gift cards from major brands

- Cash back via direct deposit or statement credit

- Charitable donations

Premium cardholders can transfer points to airline partners at a 1:1 ratio, though transfer rates differ by card type. Citi Strata Premier and Prestige cardholders get full transfer benefits that prove valuable when redeeming for international travel.

International Banking Benefits

Citibank’s worldwide presence creates unique advantages for clients with global needs. Their network handles payments in over 140 currencies and offers competitive exchange rates. The bank provides:

- Cross-border private banking services across regions

- Dedicated banking teams in each global region

- Multiple account options for overseas business or personal interests

Travelers enjoy these special perks:

- Unlimited ATM fee refunds worldwide

- No foreign exchange fees on debit purchases

- Next-day foreign currency delivery service

- Emergency cash access up to USD 10,000 daily

Citibank Savings Tools

The bank combines automated and flexible savings solutions. Account holders get:

- Automatic savings programs through direct deposit splitting

- Recurring transfer scheduling options

- Immediate account alerts

- Mobile check deposit capabilities

Savings accounts come with FDIC insurance protection up to USD 250,000. The bank’s relationship tiers offer additional benefits:

- Citigold Private Client status with USD 800,000 balance

- Citigold tier at USD 180,000

- Citi Priority level starting at USD 30,000

Citibank’s digital platform makes financial management easier with budgeting tools and automated savings options. Account alerts and 24/7 support protect against fraud and identity theft, which adds security to international transactions.

Marcus by Goldman Sachs: Premium Savings Rates

Image Source: Marcus by Goldman Sachs

Marcus by Goldman Sachs stands out with premium savings rates that outperform traditional banks by eight times the national average. The online bank’s exceptional customer satisfaction earned it the top spot in J.D. Power’s 2024 Direct Banking Satisfaction Study.

High-Yield Savings Features

The Online Savings Account delivers a competitive 3.90% APY and requires no minimum deposit to start earning interest. Users benefit from daily interest compounding instead of monthly or quarterly calculations, which maximizes yearly earnings. Quick access to funds comes through same-day transfers up to USD 100,000.

No-Fee Structure Benefits

Marcus keeps things transparent with its fee-free approach:

- Zero monthly maintenance charges

- No minimum balance requirements

- Free wire transfers

- Complimentary ACH transfers

In spite of that, accounts need regular activity since zero balances or unfunded accounts face closure after 60 days. The bank accepts deposits through various methods, except cash deposits:

- Direct deposit payments

- Wire transfers

- Mobile check deposits

- Traditional check deposits

Marcus Insights Tools

Marcus’s mobile app makes financial management simple with accessible features. Marcus Insights gives users complete tools for:

- Account aggregation across multiple institutions

- Spending history analysis

- Budget forecasting capabilities

- Customized financial insights

The platform keeps deposits safe with FDIC insurance protection up to USD 250,000 per depositor. Customer support remains available through multiple channels:

- 24/7 phone assistance

- Live chat options

- Online support resources

Marcus goes beyond simple savings features by offering certificates of deposit with nine terms ranging from six months to six years. The bank’s competitive rates extend to its CD offerings, with a 4.25% APY for 12-month terms. This combination of premium rates, reliable digital tools, and fee-free banking makes Marcus one of America’s leading savings institutions.

American Express Bank: Member Rewards Integration

Image Source: American Express

American Express raises traditional banking standards with uninterrupted integration of savings accounts and membership rewards. Their high-yield savings account now provides a 3.70% APY, making it one of the top financial institutions in the United States.

High-Yield Savings Options

American Express’s High Yield Savings Account removes common obstacles that prevent wealth building with a customer-focused approach. The account comes with these benefits:

- Zero monthly maintenance fees

- No minimum deposit requirements

- No overdraft charges

- Unlimited withdrawals per statement cycle

Daily interest compounds add up, and the account includes FDIC insurance protection up to $250,000 per depositor. The bank provides round-the-clock customer service through phone support and online chat options.

Membership Rewards Connection

The bank’s rewards program adds distinct value through checking account integration. Account holders receive these benefits:

- One Membership Rewards point for every $2 spent on eligible debit card purchases

- Unlimited point-earning potential

- Flexible redemption options for deposits

The checking accounts automatically connect points to existing Membership Rewards program accounts. This setup allows cardholders to:

- Combine points from multiple sources

- Transfer points to partner airline and hotel programs

- Redeem rewards for deposits into checking accounts

AmEx Banking Features

American Express’s mobile app simplifies account management with user-friendly tools. The platform receives high ratings on the App Store and includes:

- Immediate account monitoring

- Mobile check deposits

- Point balance tracking

Customers can make contactless payments through Apple Pay and Google Pay integration. They also get fee-free withdrawals at over 70,000 ATMs nationwide through the Allpoint and MoneyPass networks.

The bank continues to accept new ideas with third-party integration. Mutually beneficial alliances with platforms like Envestnet | Yodlee help customers connect their American Express accounts securely with trusted financial applications. This connection provides:

- Immediate data sharing

- Better financial planning

- Boosted expense management

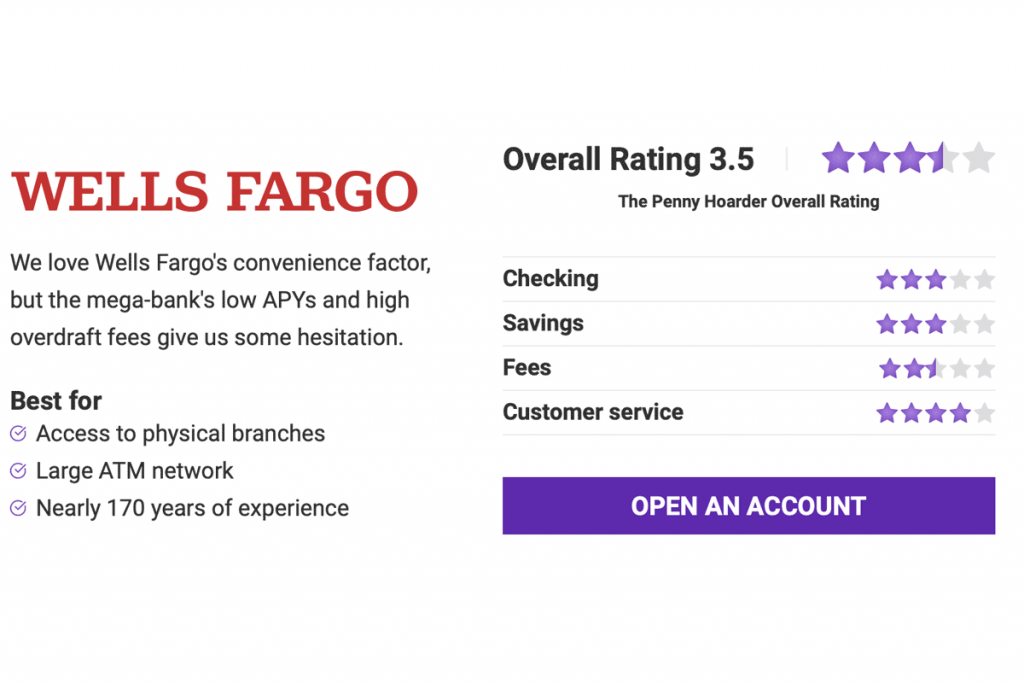

Wells Fargo: Comprehensive Banking Solutions

Image Source: The Penny Hoarder

Wells Fargo provides expandable banking solutions that meet financial needs of all types through creative savings programs and rewards integration. The bank shows its steadfast dedication to customer success at every service level.

Way2Save Program Features

The Way2Save® savings account makes wealth building easier with automated tools. You’ll need just USD 25 to get started. The USD 5 monthly fee can be avoided through these options:

- USD 300 minimum daily balance

- Monthly automatic transfers of USD 25

- Daily transfers of USD 1 from checking

- Save As You Go transfers

Save As You Go moves USD 1 from checking to savings automatically when you make non-recurring debit purchases or pay bills online. This method helps customers build their savings naturally during everyday transactions.

Portfolio Banking Benefits

Wells Fargo’s Premier Checking account rewards relationship banking with premium perks. Members get:

- Support from a dedicated Premier banking team

- Better interest rates on CDs and savings

- No fees for wire transfers and cashier’s checks

- Exclusive credit card reward offers

The Premier program gives investment-focused clients a 0.10% discount on Intuitive Investor® advisory fees, down from the standard 0.35%. Your portfolio values above USD 250,000 unlock better benefits and eliminate the USD 35 monthly service charge.

Wells Fargo Rewards

The rewards program lets members redeem their points in multiple ways. You can:

- Get statement credits

- Book travel

- Choose gift cards

- Shop with PayPal

Special promotions take the rewards program to new heights. New cardholders can earn big bonuses – like 60,000 points after spending USD 4,000 in three months. The combination of savings tools, portfolio benefits, and rewards creates a tailored banking experience that matches your financial goals.

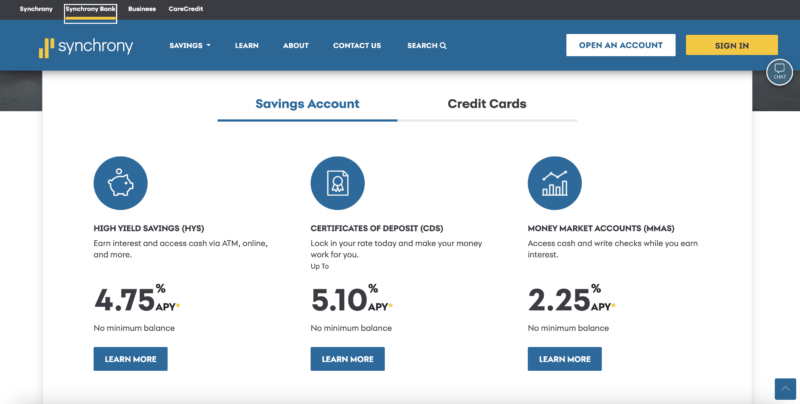

Synchrony Bank: High-Yield Specialist

Image Source: Wallet Hacks

Synchrony Bank stands out as an online banking leader with its high-yield savings account that offers a competitive 4.00% APY. The bank’s fee-free banking approach makes it unique in the digital world.

Premium Savings Rates

The High Yield Savings account makes building wealth easier with these features:

- No minimum deposit requirements

- Zero monthly maintenance fees

- Daily interest compounding

- Optional ATM card access

Customers can quickly access their financial information and transfer funds or pay bills without waiting in lines. This saves money on traditional banking expenses such as stamps, envelopes, and paper checks.

CD Account Options

Synchrony’s Certificate of Deposit products come with multiple terms and rates up to 4.35% APY. The bank offers three CD types:

- Standard CDs with terms from 3 months to 5 years

- 24-month Bump-Up CD allowing one rate increase

- 11-month No-Penalty CD for flexible withdrawals

Early withdrawal penalties vary from 90 to 365 days of simple interest based on term length. Earned interest remains available penalty-free anytime. Account holders get a 10-day grace period after maturity to add funds, renew, or withdraw money.

Digital Banking Tools

Synchrony Bank’s mobile app gives users complete financial management features:

- Mobile check deposits with USD 2,000 daily limits

- Account aggregation capabilities

- Customizable alert settings

- Secure socket language encryption

The bank provides customer service from 8 a.m. to 10 p.m. ET on weekdays and 8 a.m. to 5 p.m. ET on weekends to improve security. All deposit accounts ended up having FDIC insurance protection up to USD 250,000 per ownership category.

Built-in calculators on the bank’s online platform help project savings growth and understand loan costs. Synchrony enables customers to optimize their finances through automated recurring transfers and online bill payments.

UFB Direct: Rising Star in Savings

Image Source: YouTube

UFB Direct, the online arm of Axos Bank, has become a major player in the savings world by offering an impressive 4.01% APY across all balance tiers.

Industry-Leading APY

The UFB Portfolio Savings account shines with its tiered interest structure that keeps rates steady across all balance levels. Account holders earn:

- 4.01% APY for balances from USD 0 to USD 9,999.99

- 4.01% APY for balances between USD 10,000 to USD 24,999.99

- 4.01% APY for balances USD 25,000 and above

The bank rewards customers who bundle their accounts. Opening a UFB Freedom Checking account with savings gives you an extra 0.20% APY, which takes potential earnings up to 4.21%.

Premium Banking Features

The Portfolio Savings account removes typical banking hassles with:

- No maintenance or service fees

- No minimum deposit needs

- Free ATM card access

- Free transfers between direct deposit accounts

The bank’s three-tier bonus structure helps maximize earnings:

- Get 0.05% APY by setting up monthly direct deposits of USD 5,000 or more

- Earn 0.10% APY by keeping USD 10,000+ savings balance

- Add 0.05% APY when you make 10 eligible debit card purchases each statement cycle

Mobile Banking Capabilities

UFB Direct’s mobile app scores high with users – 4.7 on Google Play and 4.8 on Apple Store. The app packs useful digital banking features:

- Deposit checks using your phone’s camera

- Check account balances right away

- Pay bills without hassle

- Track your balance trends

The platform uses Secure Socket Layer 128-bit encryption to keep transactions safe. SMS banking options let you access your account even without internet. UFB Direct combines top-tier rates with reliable digital tools, making it one of America’s top savings banks.

Comparison Table

| Bank Name | APY Rate | Minimum Requirements | Key Features/Programs | ATM Network | Notable Rewards/Benefits |

|---|---|---|---|---|---|

| Chase Bank | Not mentioned | Not mentioned | Autosave feature, Chase Ultimate Rewards® | 15,000 ATMs, 4,700+ branches | 1-15x bonus points at 450+ stores, $300 new account bonus |

| Capital One 360 | 3.70% | No minimum | Multiple savings accounts, AutoSave feature | 70,000+ fee-free ATMs | Capital One Shopping rewards, CreditWise monitoring |

| Ally Bank | 4.20% | No minimum | Smart Savings Buckets (up to 30), Round-Up program | 43,000+ Allpoint® ATMs | Up to $10 monthly ATM fee reimbursement |

| Discover Bank | Not mentioned | No minimum | Early Pay, Cashback Debit | 60,000+ fee-free ATMs | 1% cashback on up to $3,000 monthly debit purchases |

| Bank of America | 0.02-0.04% (tiered) | $20,000 (for rewards) | Preferred Rewards program, Life Plan® tools | Not mentioned | 25-75% credit card rewards bonus (tiered) |

| Citibank | Not mentioned | Not mentioned | ThankYou® Points, Global Banking | Operations in 160 countries | 1:1 point transfers to travel partners |

| Marcus by Goldman Sachs | 3.90% | No minimum | Marcus Insights tools, Same-day transfers | Not mentioned | Daily interest compounding, J.D. Power top satisfaction |

| American Express | 3.70% | No minimum | Membership Rewards integration | 70,000+ fee-free ATMs | 1 point per $2 on debit purchases |

| Wells Fargo | Not mentioned | $25 (Way2Save) | Way2Save program, Portfolio Banking | Not mentioned | Save As You Go transfers, Premier banking benefits |

| Synchrony Bank | 4.00% | No minimum | High-yield savings, Multiple CD options | ATM card available | No monthly fees, daily interest compounding |

| UFB Direct | 4.01% | No minimum | Portfolio Savings, Tiered bonus structure | Not mentioned | Up to 4.21% APY with checking bundle |

Conclusion

American banks give you amazing ways to save money with competitive APY rates from 3.70% to 4.21%, huge ATM networks, and smart digital tools. UFB Direct tops the list with a 4.01% APY, while big names like Chase and Capital One give you great rewards programs to boost your savings.

Your perfect bank depends on what you need. Chase works best if you love rewards through its Ultimate Rewards program. Ally Bank’s bucket system helps you save for specific goals. Capital One mixes high yields with shopping rewards, and Discover shines with its 1% cashback debit program.

Most banks, especially online ones like Marcus and UFB Direct, have dropped their fees completely. You won’t find minimum deposits or maintenance fees here, which means everyone can access these premium savings rates.

Modern banking is all about digital tools and automation. Ally’s Round-Up program, Chase’s Autosave, and Capital One’s automated savings rules make building wealth easier. The ATM networks are impressive too – from Chase’s 15,000 locations to Capital One’s network of over 70,000 fee-free ATMs across the country.

The right bank for you should have good APY rates, minimal fees, useful digital features, and reward programs that match your financial goals. You’ll want to find one that gives you competitive rates and features that fit how you bank and save.